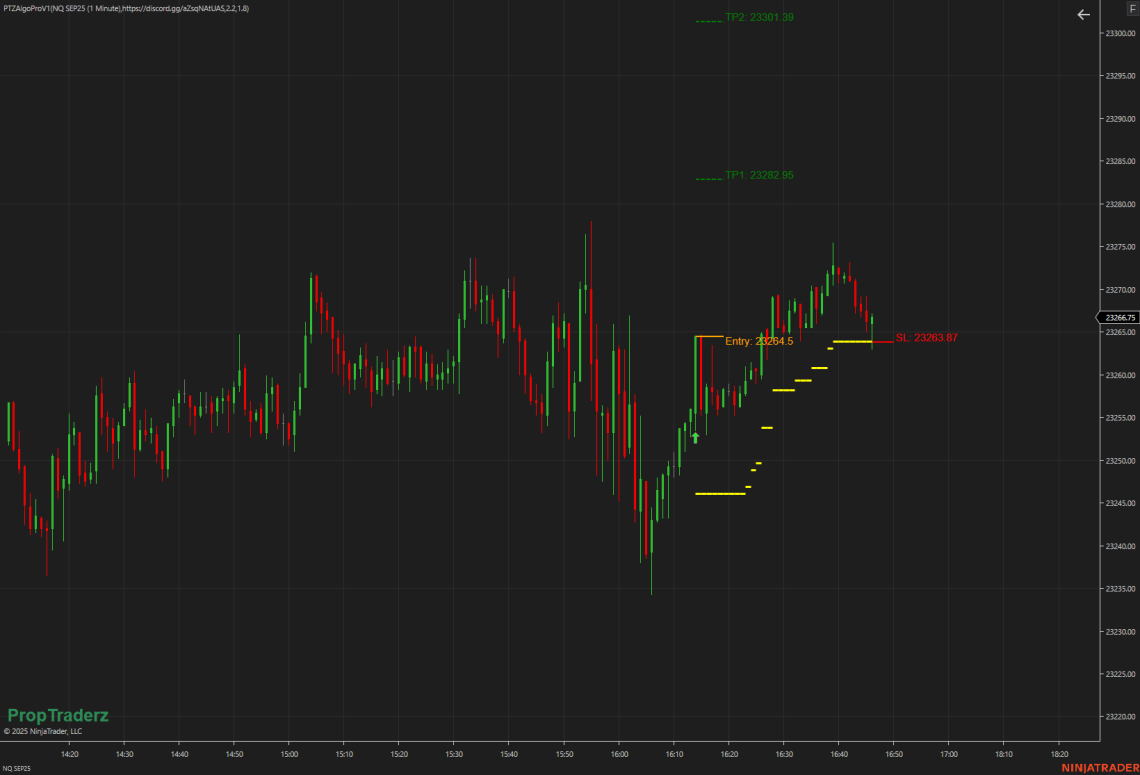

Algo ProV1

What It Does

AlgoProV1 blends a tried‑and‑true SuperTrend trend filter with an ATR‑based stop‑loss that trails and plots clear profit targets—so you can focus on trading, not chart clutter.

-

Trend Detection

-

Computes a “SuperTrend” line by taking the average of high/low/close/open (HLCO) and offsetting it by ATR×Sensitivity.

-

When price crosses above the upper band, a long signal is triggered; crossing below the lower band gives a short signal.

-

Entry arrows mark the exact bar of the SuperTrend flip.

-

Send download link to:AlgoProV1

-

Dynamic Stop‑Loss (SL)

-

-

On entry, SL is set at entry ± ATR×SLFactor.

-

As the trade progresses, the indicator recalculates ATR×SLFactor each bar.

-

Only if this new level is more protective (higher for longs, lower for shorts) does the SL ratchet toward the current price.

-

A yellow trail line tracks that ratcheting path, and a bold red SL stub at the chart edge shows your live stop level.

-

-

Profit Targets (TPs)

-

Three horizontal green dashes represent TP1, TP2, and TP3 at 1×, 2×, and 3× the initial ATR distance from entry.

-

These lines stretch from the entry bar all the way to the latest candle, keeping your targets in view until the trade closes.

-

How It Works Algo ProV1

-

Wait for a Trend Flip

-

The SuperTrend bands adapt to volatility via your ATR Sensitivity setting.

-

When price breaks out of the band, you get a clear arrow marking your entry bar.

-

-

Set and Show Your SL & TPs

-

Instantly lay down an initial SL a fixed ATR distance away and three profit levels beyond.

-

All lines draw from the entry bar through the chart in one continuous glance.

-

-

Watch the Trail Work for You

-

As price moves your way, the ATR‑trail (yellow) and SL stub (red) ratchet in—tightening your risk—but they stay put if price bumps back.

-

You’re never stopped out by a small retracement, only by a genuine trend reversal.

-

Why Traders Love It

-

No Guesswork on Stops: ATR adapts to changing volatility, so you don’t pinch yourself out on random whipsaws.

-

Clean, Persistent Visuals: Entry, stops, and targets remain visible from the moment of signal until you exit.

-

One‑Click Configuration: Tweak Sensitivity and SLFactor to suit your preferred risk profile—everything else plots automatically.