G

Indicators starting with G

-

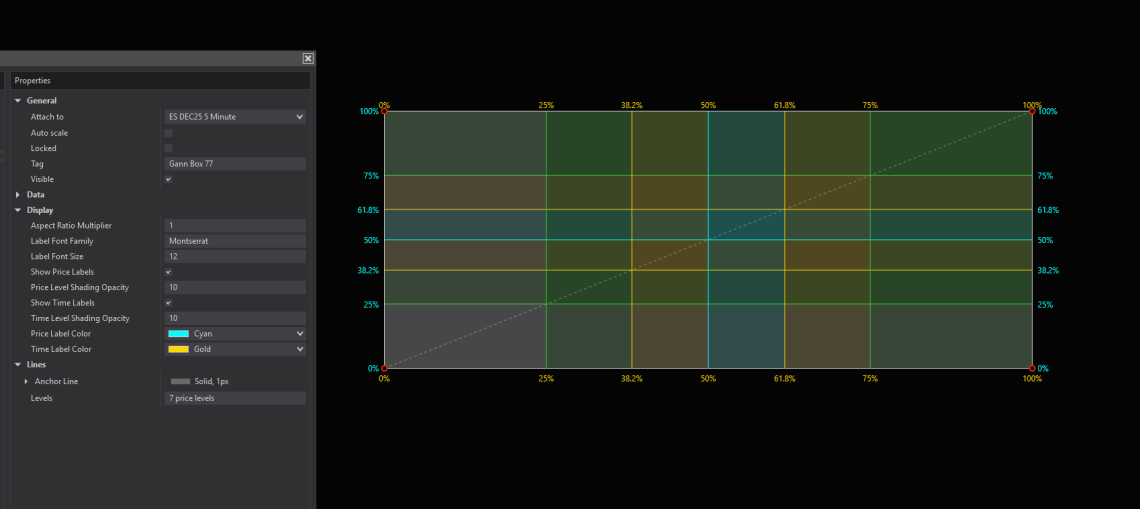

Advanced Gann Box for NinjaTrader

Advanced Gann Box for NinjaTrader 8 Free precision tool created by CampervanSeth — shared by PropTraderz Bring precision, geometry, and balance to your chart analysis with the Advanced Gann Box — rooted in W.D. Gann principles and enhanced for modern futures trading. Key Features Dual Synchronization of Price and Time Levels Dynamic Shading & Opacity Control Adjustable Aspect Ratio Multiplier Full Label Customization (fonts, colors, sizes) Smooth Interaction & Editing with aspect-ratio lock Enhanced Visual Design – crisp DirectX rendering Works on all futures contracts • 100% Free

-

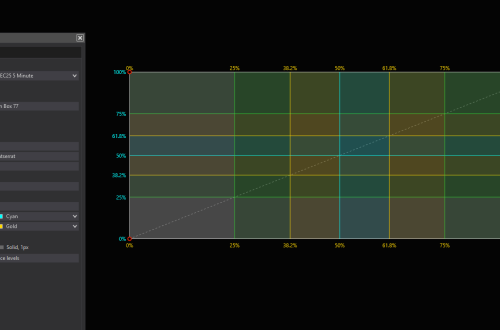

Golden Setup Tony Rago Strategy

This update introduces a refined version of the GoldenSetup indicator with: ✅ Dynamic Golden Levels (00, 12, 26, 33, 50, 62, 77, 88) plotted across ±100 zones ✅ Fully customizable visibility toggle via chart button (Show Lvls / Hide Lvls) ✅ Custom stroke styles and per-level visibility control ✅ Buy/Sell signal logic for each level combination with optional target markers ✅ Nearest level display on chart ✅ Customizable label position, size, bold, and opacity settings ✅ Improved rendering and cleanup for smoother chart interaction SCROLL DOWN FOR VIDEO In order to use the ATM’s, UNZIPP THE FILE FOLDER AND COPY PASTE THE CS FILES INTO: NT8-templates-AtmStrategy folder Golden Setup Tony…

-

Golden Setup-Tony Rago

Mastering the Golden Setup Strategy NEW UPDATE The Golden Setup-Tony Rago Strategy, it’s developed by Tony Rago, and is a powerful method tailored for trading the E-mini NASDAQ Futures (NQ). This strategy focuses on price retracements within defined 100-handle blocks, offering traders structured and repeatable trade opportunities. Here’s an in-depth look at the Golden Setup and how it can be effectively implemented. Understanding the Golden Setup At its core, the Golden Setup revolves around the mechanical movement of the NQ within 100-point price ranges, referred to as “100-handle blocks.” These blocks are segmented into specific key levels, such as 26, 50,…

-

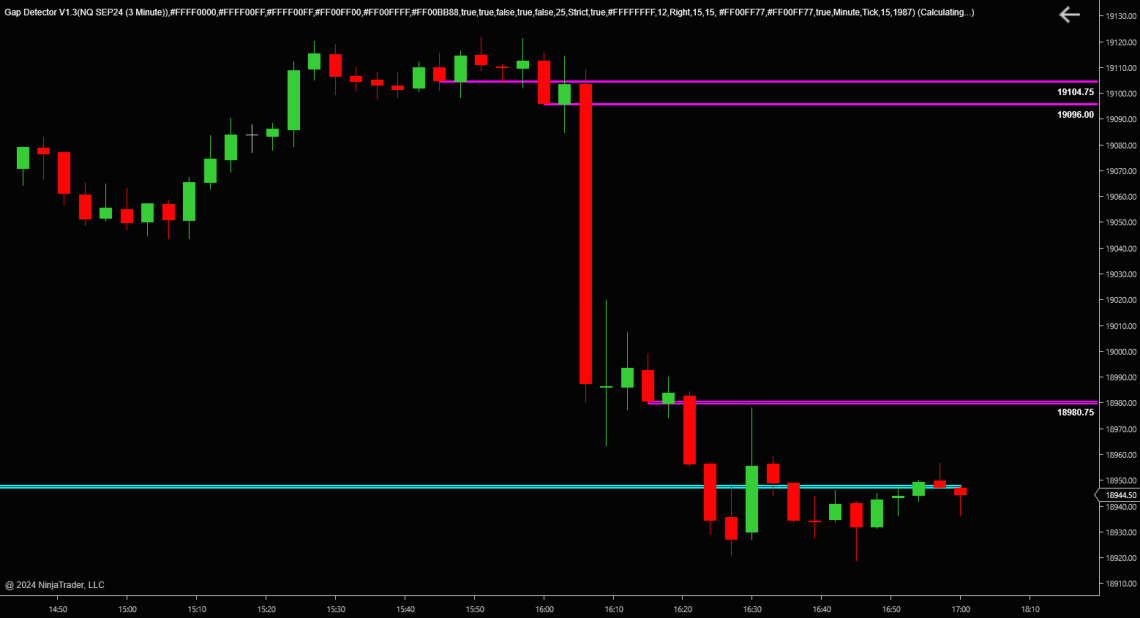

Gap Detector

FreeIndicators – Gap Detector The GapDetector is a straightforward tool that shows where the market left unfinished business. It tracks two things: true session gaps and imbalance zones created by fast, one-sided moves. Session GapsWhen the market opens above or below the previous session’s close, the indicator marks the gap and extends it forward until price trades back through it. These areas often act as magnets or reaction points. Imbalance ZonesImbalances appear when price moves too quickly, leaving thin or inefficient trading behind. The indicator highlights these areas and keeps them active until the market revisits and fills them. You can run imbalances on multiple timeframes at the same…

-

Getting Funded as a Prop Trader: Why Choose a Prop Firm over a Self-Funded Account

GETTING FUNDED AS A PROP TRADER: WHY CHOOSE A PROP FIRM OVER A SELF-FUNDED ACCOUNT Getting funded as a trader can be challenging, but it’s a crucial step in reaching your financial goals. There are two main options for getting funded – using a prop firm or self-funding. In this post, we’ll explore the advantages of using a prop firm over self-funding, and how to get funded through a prop firm. Why choose a prop firm instead of self-funding? 1. Reduced risk: Prop firms typically provide traders with a portion of the capital needed to trade. This reduces the amount of money that the trader needs to put at risk,…