Golden Setup Tony Rago Strategy

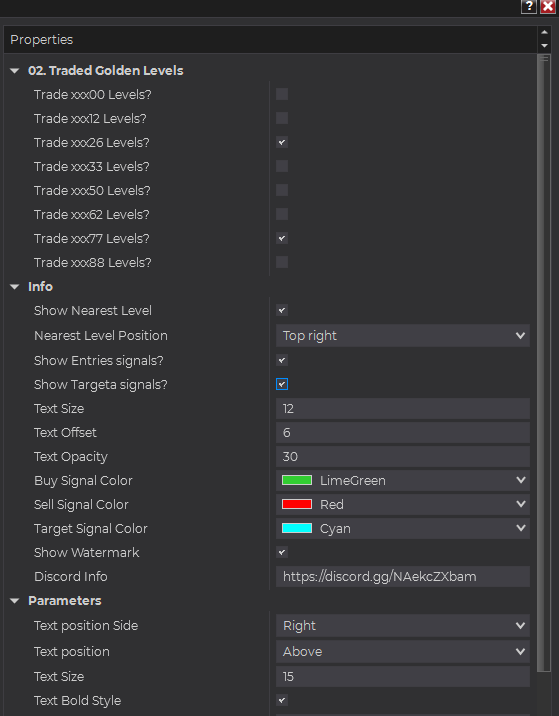

This update introduces a refined version of the GoldenSetup indicator with:

- ✅ Dynamic Golden Levels (00, 12, 26, 33, 50, 62, 77, 88) plotted across ±100 zones

- ✅ Fully customizable visibility toggle via chart button (

Show Lvls/Hide Lvls) - ✅ Custom stroke styles and per-level visibility control

- ✅ Buy/Sell signal logic for each level combination with optional target markers

- ✅ Nearest level display on chart

- ✅ Customizable label position, size, bold, and opacity settings

- ✅ Improved rendering and cleanup for smoother chart interaction

SCROLL DOWN FOR VIDEO

Send download link to:Golden Setup V4.3

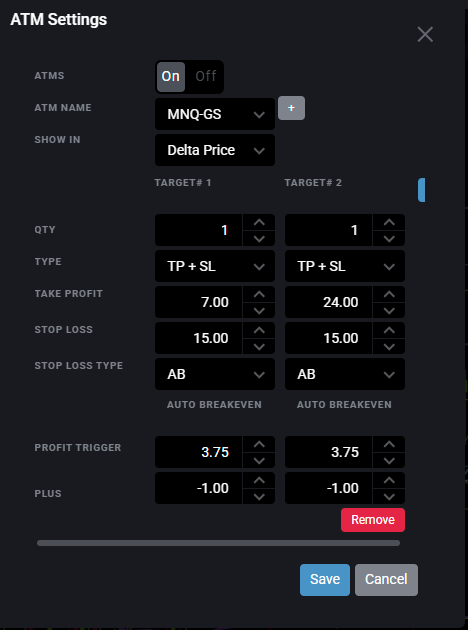

Send download link to:Golden Setup NinjaTrader ATM

In order to use the ATM’s, UNZIPP THE FILE FOLDER AND COPY PASTE THE CS FILES INTO: NT8-templates-AtmStrategy folder

Golden Setup Tony Rago Strategy its a structured, high-probability intraday trading strategy for the E-mini Nasdaq 100 futures (NQ) developed by professional trader Tony Rago. This system is praised for its 90%+ win rate when executed properly and is designed to be simple, repeatable, and effective — even for traders with limited screen time.

This setup has been refined over years and is now the backbone of TheoTrade’s NQ trading education. The strategy capitalizes on price behavior within 100-handle blocks, leveraging mechanical retracements and key inflection levels such as the 26 and 77 SPOTS.

📊The Core Concept: 100-Handle Block Mechanics

NQ price movement is segmented into logical 100-point zones, such as 17800–17900, 17900–18000, and so on. Within each block, specific price levels are used as actionable entry points and targets.

Key levels inside a 100-handle block:

-

00 / Roundy = major psychological boundary (e.g., 20000)

-

50 = midpoint of the block (e.g., 20050)

-

26 and 77 = high-probability entry SPOTS

These levels define the structure used to generate trades.

🟢 The Golden Setup: Long at the 26 Level

Golden Setup = Buy at 26 when price retraces from above (usually the 50 level) during regular trading hours.

✅ Entry Criteria:

-

Price must come down from the 50 level

-

A resting limit buy order at the 26 is placed

-

Entry is only valid on the first test of the 26 level

-

Avoid entering during high-impact news or the first 30 minutes of RTH

🎯 Targets:

-

Target 1 (T1): 33 – High-probability bounce (~91%)

-

Target 2 (T2): 50 – Potential continuation if momentum confirms

🛡️ Risk Management:

-

Use bracket orders for automatic profit-taking and stop-loss

-

If price overshoots 26 by more than 6–8 points, consider cutting the trade

-

Exit all or partial position at T1 to get “risk out”

🔻 Silver Setup: Short at 26 or Long/Short at 77

When price approaches the 26 or 77 SPOT from below, Silver Setups come into play.

📉 Silver Short 26:

-

Price moves up from the 00 (roundy) to test 26

-

Short at 26

-

Targets:

-

T1: 12 (86% win rate)

-

T2: 00

-

📈 Silver Long 77:

-

Price drops from the roundy into 77

-

Long at 77

-

Targets:

-

T1: 88

-

T2: 00 (if price closes above 88)

-

📉 Silver Short 77:

-

Price rises from 50 into 77

-

Short at 77

-

Targets:

-

T1: 62

-

T2: 50

-

📋 Supporting Setups: 12 to 50

There is also a trend continuation trade using levels like:

-

12 → 26 → 33 → 50

-

Requires bar closes above key levels (e.g., a bar close above 33 opens the door to 50)

Entry Points:

-

Aggressive: 18 or 26

-

Confirmation required: Price must hold above prior support (e.g., 22 for 26 entries)

🛠️ Execution Tips

-

Use Micro NQ (MNQ) contracts to train before switching to full NQ

-

Always enter via limit orders at SPOT levels — never chase

-

Use bracket orders to automate T1/T2 and stop-loss

-

Avoid overtrading: limit to ~10 trades per day

-

Journal each trade: spot → target, reaction at entry, overshoot behavior

🧑🏫 Tony’s Philosophy

Tony Rago emphasizes:

“One ticker. One setup. Rinse and repeat.”

This simplicity is the hallmark of consistency. By focusing only on a few key levels and setups, traders avoid analysis paralysis and become masters of execution.

📈 Real-World Results

-

Daily income potential of $300–$600 per trade

-

Some traders reported months exceeding $10,000+ in profits using only this strategy

-

Trades occur multiple times per day, offering flexibility

More About this here

✅ Final Thoughts

The Golden Setup isn’t about chasing flashy indicators — it’s about price action mastery inside a defined range. By executing trades at the 26 and 77 SPOTS and managing risk with precision, traders gain a real edge in NQ futures.

Whether you’re just starting or need to simplify a cluttered strategy book, the Golden Setup offers a consistent, focused path to profitability.

🙏 Special Thanks

Huge thanks to Victor for making the Golden Setup indicator look and work so flawlessly.

Your design brought this strategy to life — couldn’t have done it without you!

📘 Disclosure

The information provided in this article is for educational and informational purposes only and should not be considered financial advice. Trading futures involves substantial risk and is not suitable for every investor. The Golden Setup strategy, while historically profitable for some, does not guarantee future results. Always perform your own due diligence, use proper risk management, and consult with a licensed financial advisor before making any trading decisions.

Past performance is not indicative of future performance. All trading strategies are used at your own risk.