S

Indicators starting with S

-

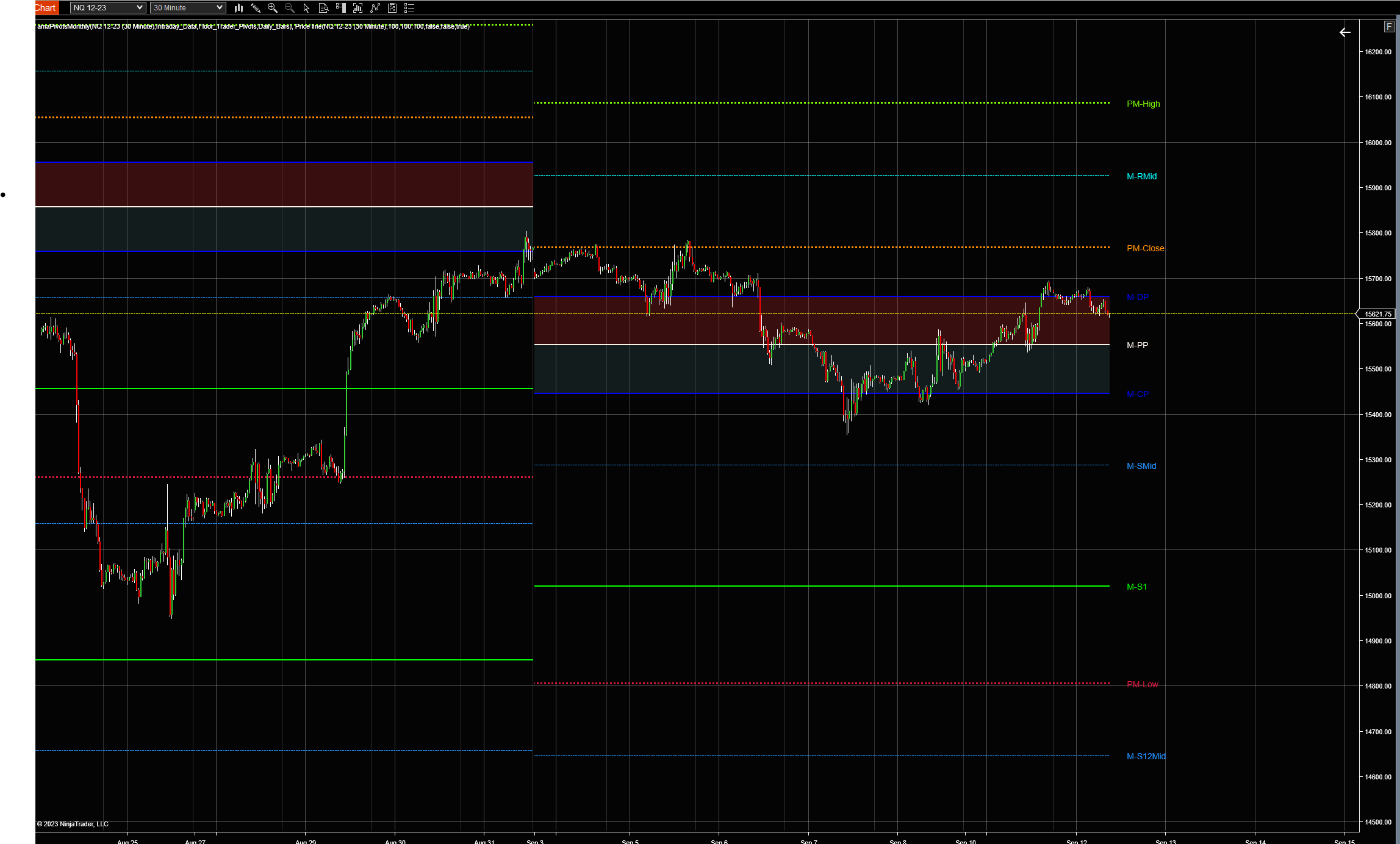

Session Pivots Monthly (amaPivotsMonthly)

The Session Pivots Monthly (amaPivotsMonthly) is an enhanced pivots indicator which allows for displaying floor pivots, wide pivots, Jackson Zones and Fibonacci pivots. All pivots are calculated from daily bars (default setting) or from the bar series that has been selected as input series. The indicator may be used to display ETH pivots on a full session chart or RTH pivots on a regular session chart. It is not designed to display RTH pivots on a full session chart. When pivots are calculated from daily bars, they are typically calculated from the full session high, the full session low and the settlement price. However, the daily data depends on the data…

-

Stock market 23 August2023

Stock Futures Mixed Ahead of Earnings Season and Fed Rate Decision Stock futures were mixed on Wednesday morning, August 23, 2023, as investors awaited the start of earnings season and the Federal Reserve’s decision on interest rates. Dow Jones Industrial Average futures were up 129 points, or 0.37%, to 34,694.** S&P 500 futures were up 23.75 points, or 0.54%, to 4,406.50. Nasdaq 100 futures were up 107 points, or 0.73%, to 14,851. Investors are looking ahead to the start of earnings season, which kicks off with major banks on Thursday. Analysts expect earnings growth to slow in the third quarter, as companies grapple with rising inflation and supply chain disruptions.…

-

Supertrend Indicator

Introduction: The world of technical analysis is constantly evolving, with new tools and indicators being developed to assist traders in making informed decisions. One such indicator that has gained popularity in recent years is the Supertrend indicator. This article explores the Supertrend indicator and its application in the volatile market of July 2023. Overview of the Supertrend Indicator: The Supertrend indicator is a versatile tool used by traders to identify the prevailing trend in the market. It offers a clear visualization of the trend direction and provides potential entry and exit points for traders. The indicator is based on a combination of price and volatility, making it suitable for various…

-

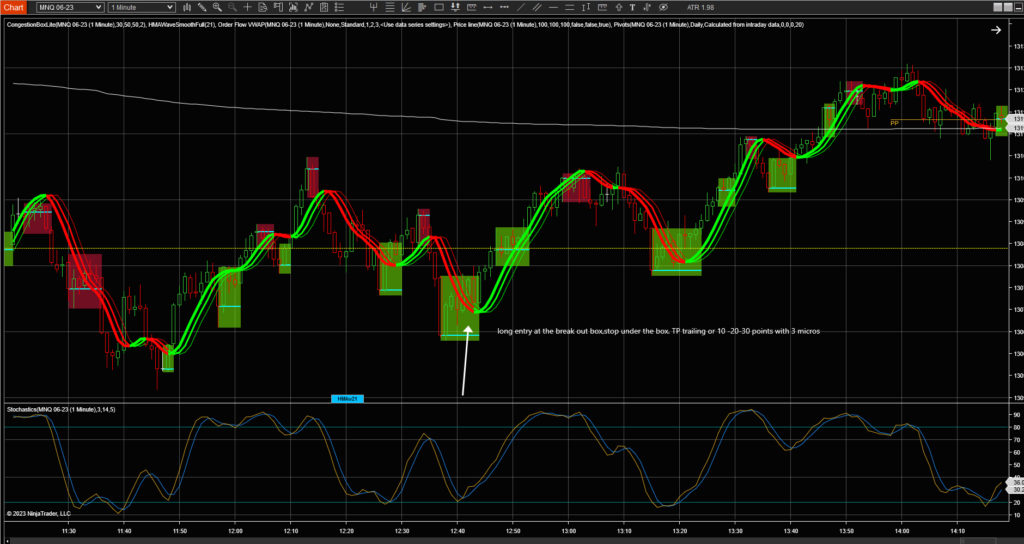

Scalping Strategy For Prop Traders

A Scalping Strategy For Prop Traders but not only- using HMA Wave, Congestion Box, and Stochastic Indicator THE SECRET: Take small profits or trail it. Do NOT become greedy Are you looking for a high-probability scalping strategy that can help you take advantage of short-term price movements in the market? If so, then this article is for you! In this article, we will explore a scalping strategy that combines the HMA Wave indicator, Congestion box, and Stochastic indicator to identify potential trading opportunities. The HMA (Hull Moving Average) Wave indicator is a powerful trend-following indicator that provides visual cues for identifying trend direction and momentum. It consists of three lines…

-

Scalping Futures with – EMA Crossover Strategy

Scalping Futures with EMA Crossover Strategy Here are a few easy strategies to scalp futures for a few ticks or points (EMA) Crossover strategy The EMA crossover strategy involves using two EMAs to identify short-term trends in the market. EMA’S values can be changed on your preference ( see addon properties after downloading and adding in NT8) The “Channel SSL” (Secure Sockets Layer) is a technical analysis tool that is used to identify trends and potential trading opportunities in the market. It is a type of channel indicator that consists of two lines, one line above the price and one line below the price, which form a channel. The Channel…

-

Sam Seiden-Supply & Demand Teaching

Sam Seiden’s teachings are based on the idea that markets move based on the laws of supply and demand, and that prices will always seek an equilibrium where supply and demand are in balance. He emphasizes the importance of understanding how to read the order flow, identifying the buyers and sellers in the market, and understanding the market participants’ motivations. He also explains how to use supply and demand levels to determine market direction, set stop-losses, and take profits.